FROM AUSTRALIA'S #1 CHARTERED ACCOUNTANT AND QUALIFIED CFO

See Exactly Where Your Money is Going, What's Truly Driving Profit, and What To Fix Next Before Growth Creates Problems.

For business owners generating $1M–$50M in revenue who want to scale profitably without second-guessing every decision.

Book Your Free Business Growth Diagnostic Session with Australis #1 Young Chartered Accountant

Have you been walking into your business lately with a strange feeling that something feels off? Revenue is growing, but cash sometimes feels tight without a clear reason why?

You want to hire, but you’re unsure whether the cashflow can truly support another salary? Clients are coming in, but you don’t know which ones are actually supporting your growth and profitability?

Deep down, you worry that more growth might make the business harder to run, not easier.

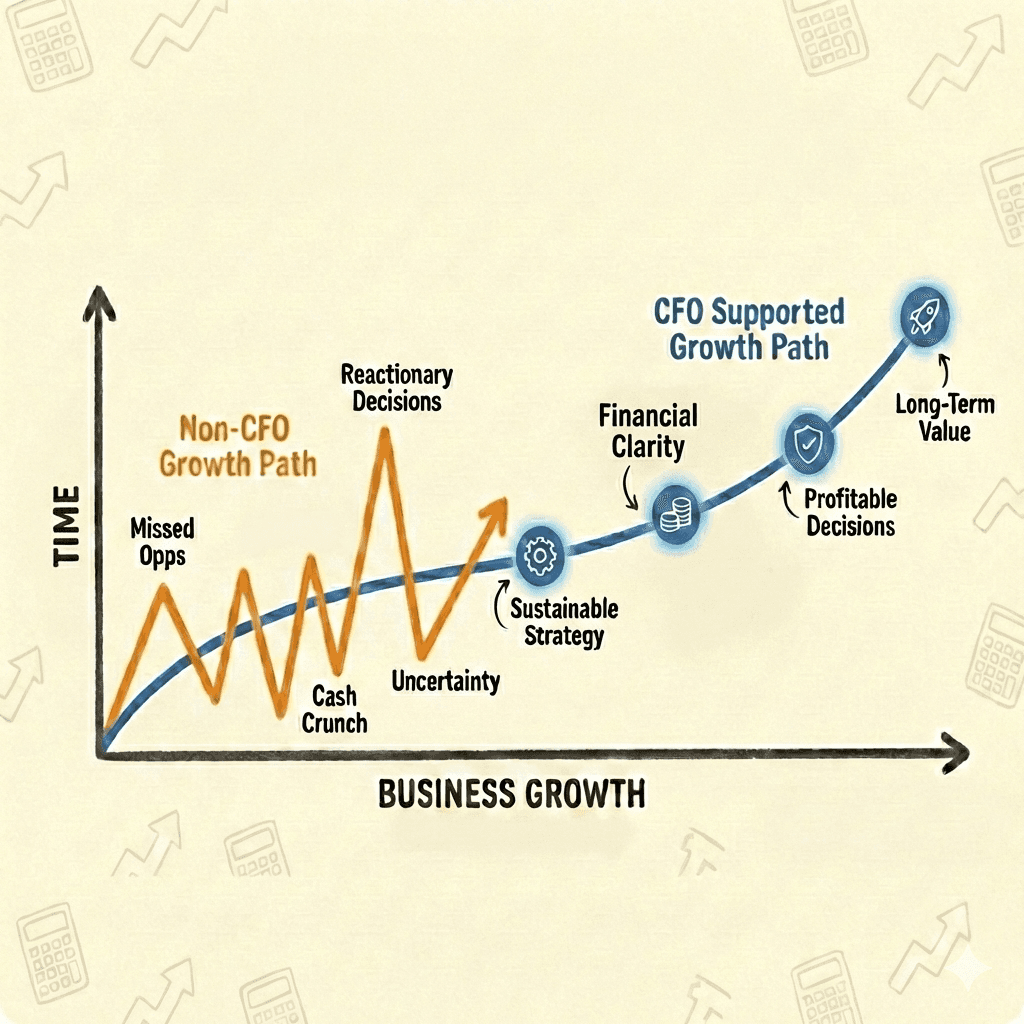

If that sounds familiar, you are not doing anything wrong. This is what growth feels like when financial clarity hasn’t caught up to help you manage your business the smart way.

The issue isn’t ambition or effort - It’s that your financial insight hasn’t evolved at the same pace as your business growth.

Simic Financial gives you the right next steps without breaking the bank

Real talk, you know that to be a truly successful business owner you need the insights of a true financial expert.

Someone who can analyse the numbers, clarify the unknown, and implement a genuine growth plan.

The problem is that many entrepreneurs just assume it’s too expensive or too complex. That’s precisely the gap Simic Financial fills.

Our work isn’t about generating more useless reports. It’s about translating your numbers into real insight so you can make empowered decision based on real data, at a fraction of the cost of an in-house Chief Financial Officer.

Our speciality lies in showing you:

Where profit is truly made

Which costs are increasing too fast

How decisions affect cashflow before you make them

What to fix now and what can wait

Clients Supported

Average Cashflow Improvement

Average Profit Improvement

Guarenteed Peace of Mind

Australia's #1 Young Chartered Accountant and CFO Advisor helping over 300 businesses grow

I’m Tom, Founder of Simic Financial where our mission is to help businesses grow into confident, successful enterprises by providing clarity, structure and expert strategic insight into their finances.

We show real untapped profit opportunities, highlight costs that could get out of control before they do, and clarify why cash can disappear even when revenue goes up. All so that you can make informed decisions and grow your business sustainably.

In your FREE Business Growth Diagnostic Session, we run a structured deep dive into your business. The goal is simple. To help you clearly understand what is happening financially and what needs to change next.

No hard sell.

No valueless back and forth.

Genuine insight and valuable conversation.

The diagnostic stands on its own, with no obligation.

"Tom from Simic Fincancial has been amazing, he really helps to just nut out where the next wave of growth is going to come from"

Branden Johns, Founder

Adventure Market

"Tom has lots of integrity and his values really aligned with us - whatever is going on in the business, whatever questions I have, Tom and his team are responsive to whatever needs to we have."

Leanne Camp, CEO

Lucky Strike Gold

"Tom challenges us and gives us confidence by looking at what comes next and how we get there."

Megan Rovers, Director

Geelong Property Hub

"Tom helps us interpret the data, turn it into actionable steps, identify where we’re winning, losing and put a gameplan in place to improve, and he really understands our business. "

Scott McDonald, Director

Aussiewide Financial Services

Our 6 Step Process To Helping You Achieve Your Growth Ambitions

A Proven Process We've Implemented Time and Time Again

Step 1

Book Your Free Growth Diagnostic

Our team will bring their expertise to look at where money is made, where pressure is coming from, and what is creating uncertainty right now. The goal to give you clarity on what matters, what does not, and what the smartest next step looks like.

Step 2

Review & Clean Up

Starting with the basics is essential to eliminate confusion by cleaning up reports, fixing gaps, and making sure the numbers reflect reality. When the foundations are solid, everything else becomes easier to understand and easier to manage.

Step 3

Risk Check

We identify pressure points across cash flow, costs, pricing, and structure. The aim is not to slow growth down, but to remove surprises so progress feels controlled instead of stressful.

Step 4

Plan and KPIs

Once clarity is established, we turn it into direction by focusing on setting clear goals and prioritising key metrics that actually drive results. Instead of tracking everything, you focus on what moves the business forward.

Step 5

Regular Check-Ins

Growth is not set and forget. Regular check-ins help you stay on track, review what changed, and adjust decisions early. We work with you to keep momentum steady and prevents small issues from becoming big problems.

Step 6

Build Longterm Value & Scalability

Over time, clarity and consistency compound. Cash becomes more predictable, decisions feel lighter, and the business becomes easier to run. This is where stability, confidence, and long-term value are built, not by chance, but by design.